Dispute Workstation

Dispute

Workstation

Re-imagining the

next-generation online

dispute resolution

experience

(Due to confidentiality agreements I can only show a small set of examples and some images have been edited.)

DURATION

9 months +

DESIGN TEAM

Product owner- 2

Business analyst

Development teams - 2

Program manager

DESIGN TEAM

Lead Product designer (me)

UX designers - 2

MY ROLE

UX strategy and planning

Wireframes and detail design

Guide design team

Manage project delivery

Business sign-offs

Challenge

The legacy product, developed by Fiserv, had complex workflows, functional gaps, multiple system dependencies, and an outdated interface. It was difficult to provide timely installations and upgrades to their customers (banks).

As a result of rapidly evolving technology, new competitors, and increasing consumer expectations, there has been a constant pressure to become more productive and efficient.

Solution

An online application that streamlines dispute processing with simple, efficient workflows for dispute agents to keep productivity high and superior compliance.

My Role

Led a team of 2 UX/UI designers and user testing consultant. I owned the product experience and UX strategy. My responsibilities included planning the project, collaborating with business for shaping requirements and working with development teams for design and delivery.

Finding this interesting?

APPROACH

Plan, research and break up task

Dispute agents undergo specialized training for domain knowledge. Their work involves analyzing information and decision-making. Errors and delays can result in significant penalties and financial losses. The current application was complex with non-linear workflows. Designing a modernized web application needed an approach that simplified and reduced complexity.

Process

The process was very collaborative and built on a shared understanding among stakeholders, developers and designers. User feedback and domain expertise was woven into every stage of design.

DISCOVER

Getting started

I spearheaded a shared project board to communicate the product vision and ensure complete visibility and alignment across the cross-functional teams. All teams captured their project work and progress, ideas, and related content on the board. I also facilitated multiple workshops with the business, SMEs/trainers and the technology teams to map the current state flows, future experience feature board, interface elements and interaction.

RESEARCH

User research

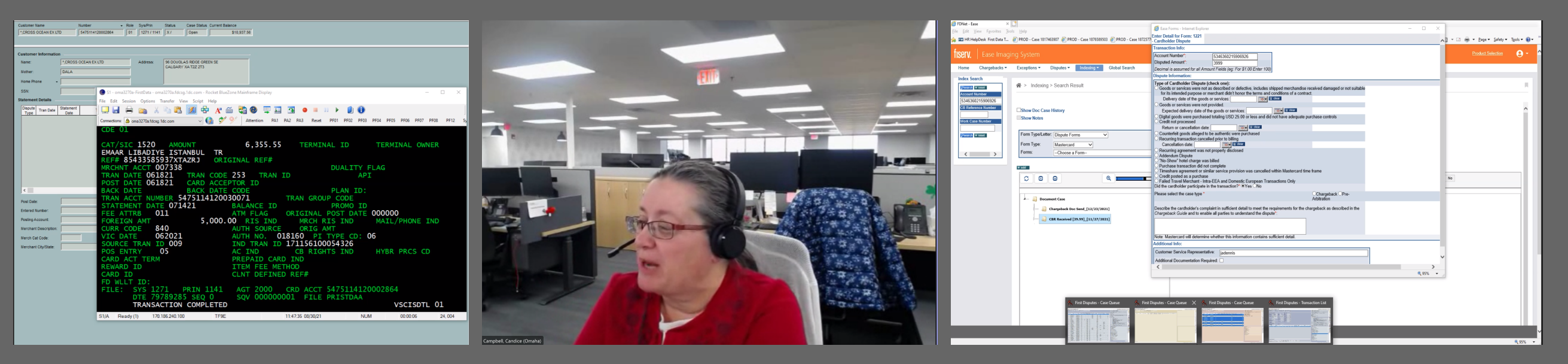

My design team and I shadowed dispute operators to understand how they work. We also interviewed users to collect additional qualitative information. This effort yielded critical information regarding workflows, compliance requirements, agent preferences, as well as individual workarounds and shortcuts.

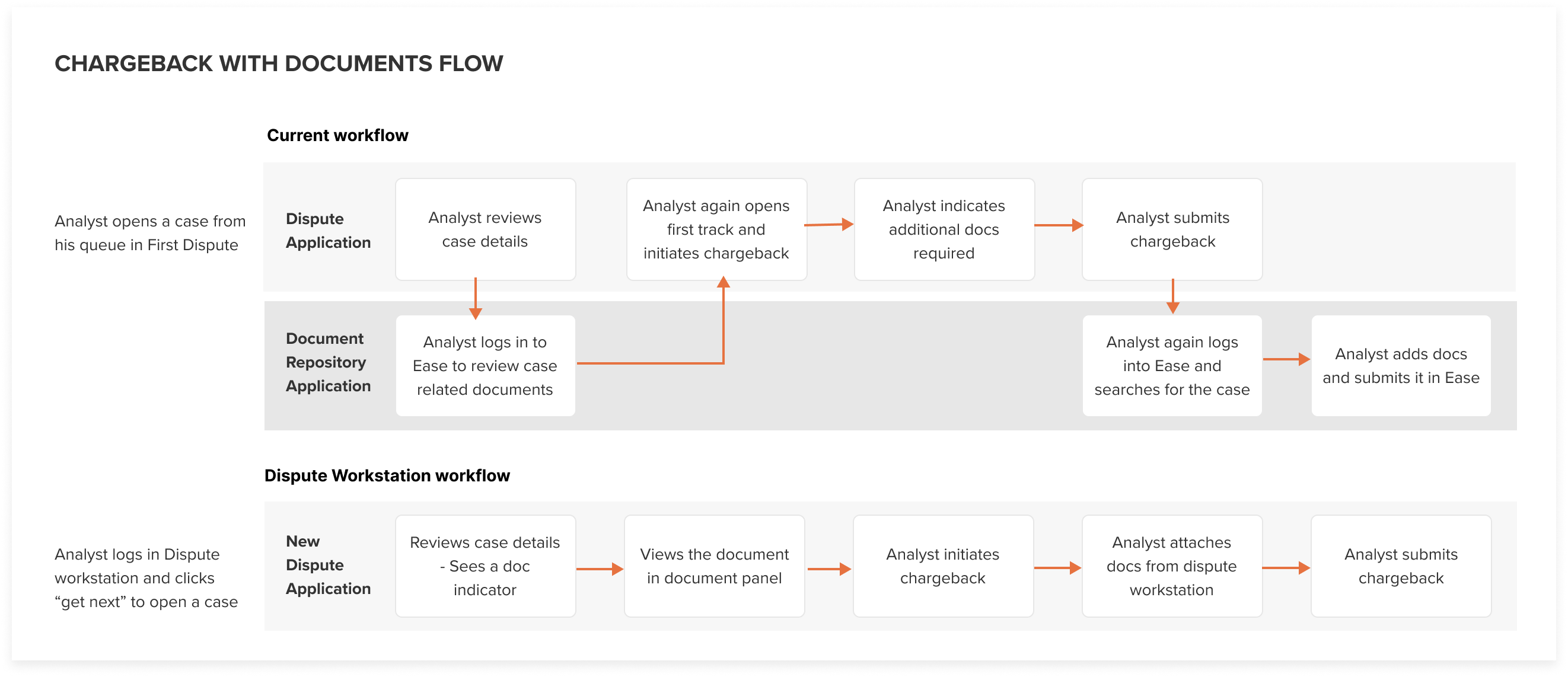

Agents suffered from redundant and duplicative tasks, had to switch multiple applications, and had to hunt around for relevant information. They depended heavily on team notes, cheatsheets and training manuals.

“It’s a long list of actions. I don’t know what many of these actions do. I only use a few of them”

Analyst

“I spend 30 mins every morning just looking through my queue and figuring out which cases need attention.”

Senior Analyst

“For attaching documents we have to use a different application. It’s a pain to keep logging in for every case as it time-outs”

Analyst

“Case load is heavy these days and sometimes it’s just easier to pend the case so that I don’t miss out on my timelines.”

Analyst

Design challenges

Strike a balance between legacy and new experience to encourage product adoption.

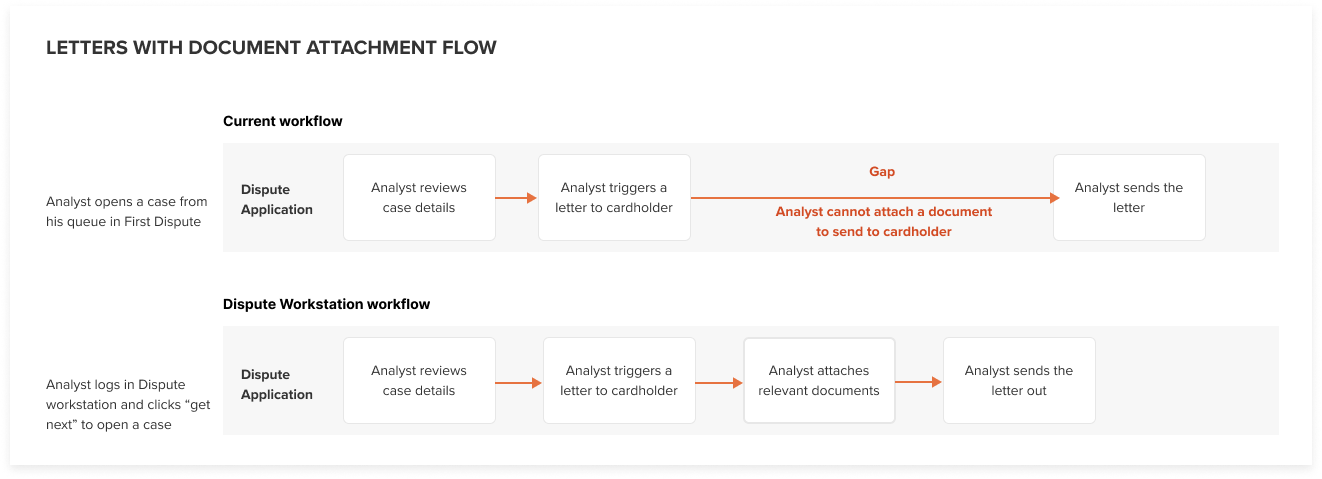

Merge 2 legacy applications into single application.

Design for network specific workflows (Mastercard/ Visa/ Amex).

Design for flexibility and configurability.

Hypothesis

We believe that by providing dispute operators streamlined navigation with smart, automated workflows and simplifying evidence review we can increase compliance, and achieve faster and more accurate dispute processing.

Examples of streamlining the workflow with Dispute Workstation

SOLUTION

Dispute Workstation

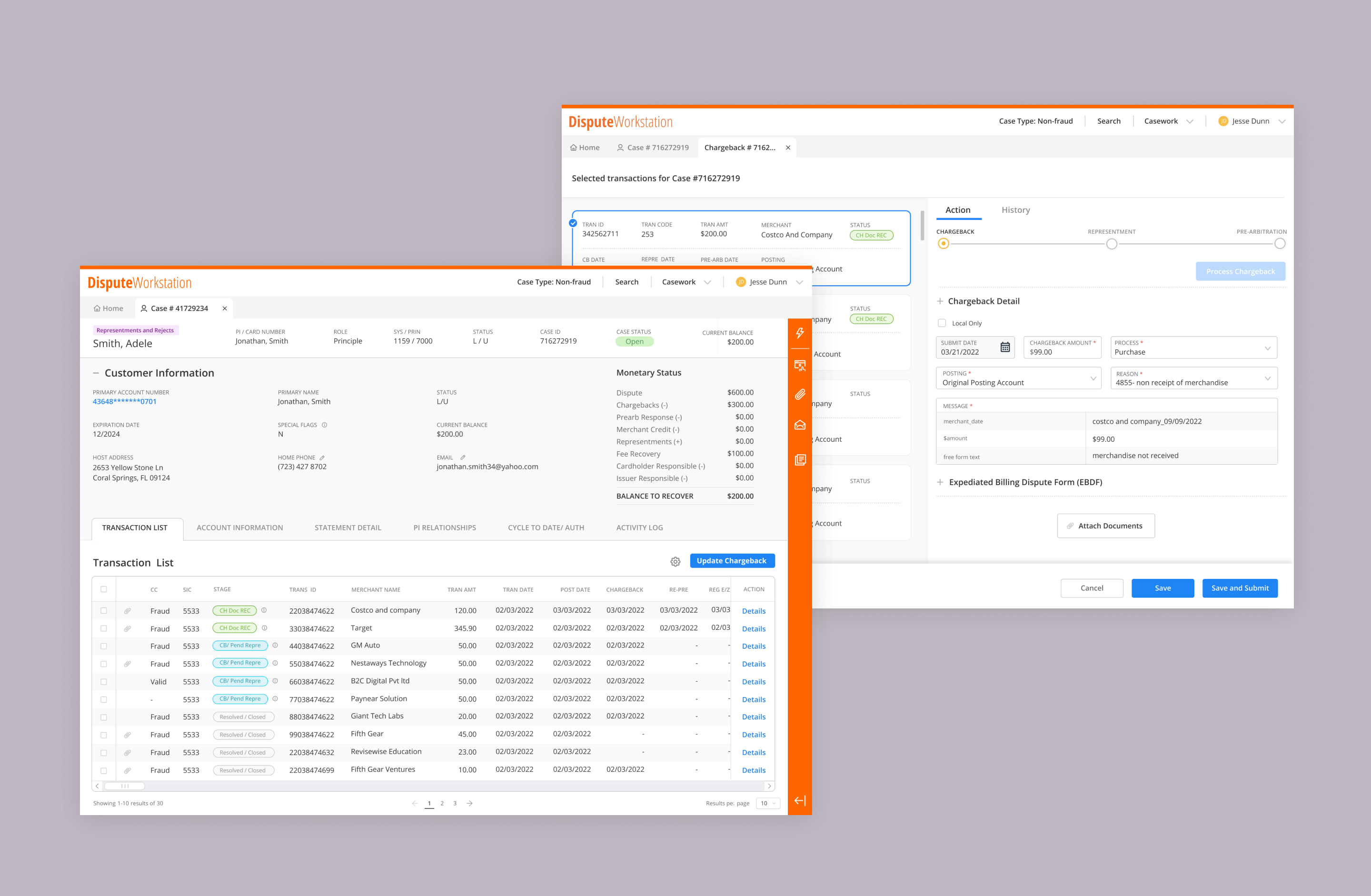

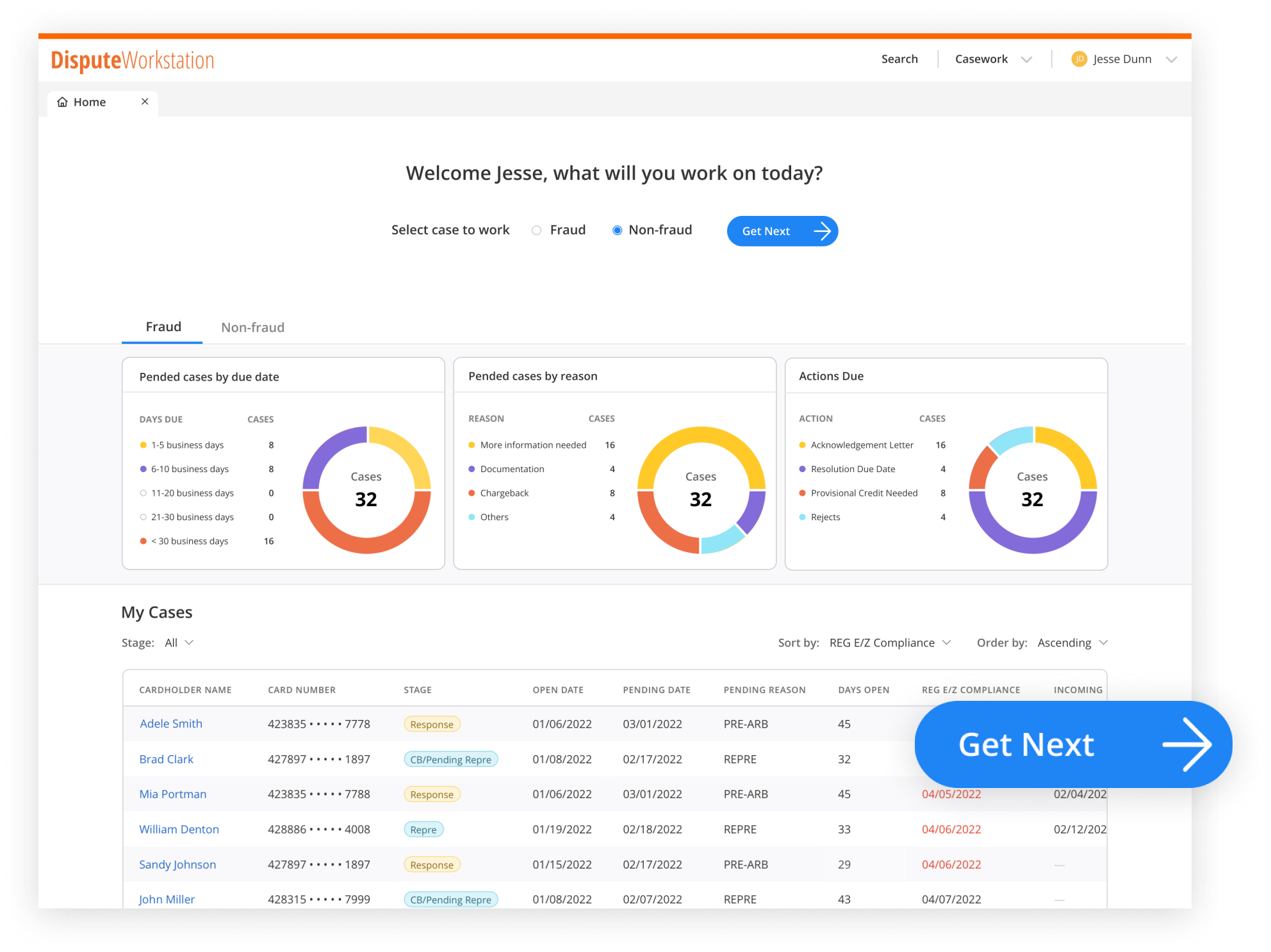

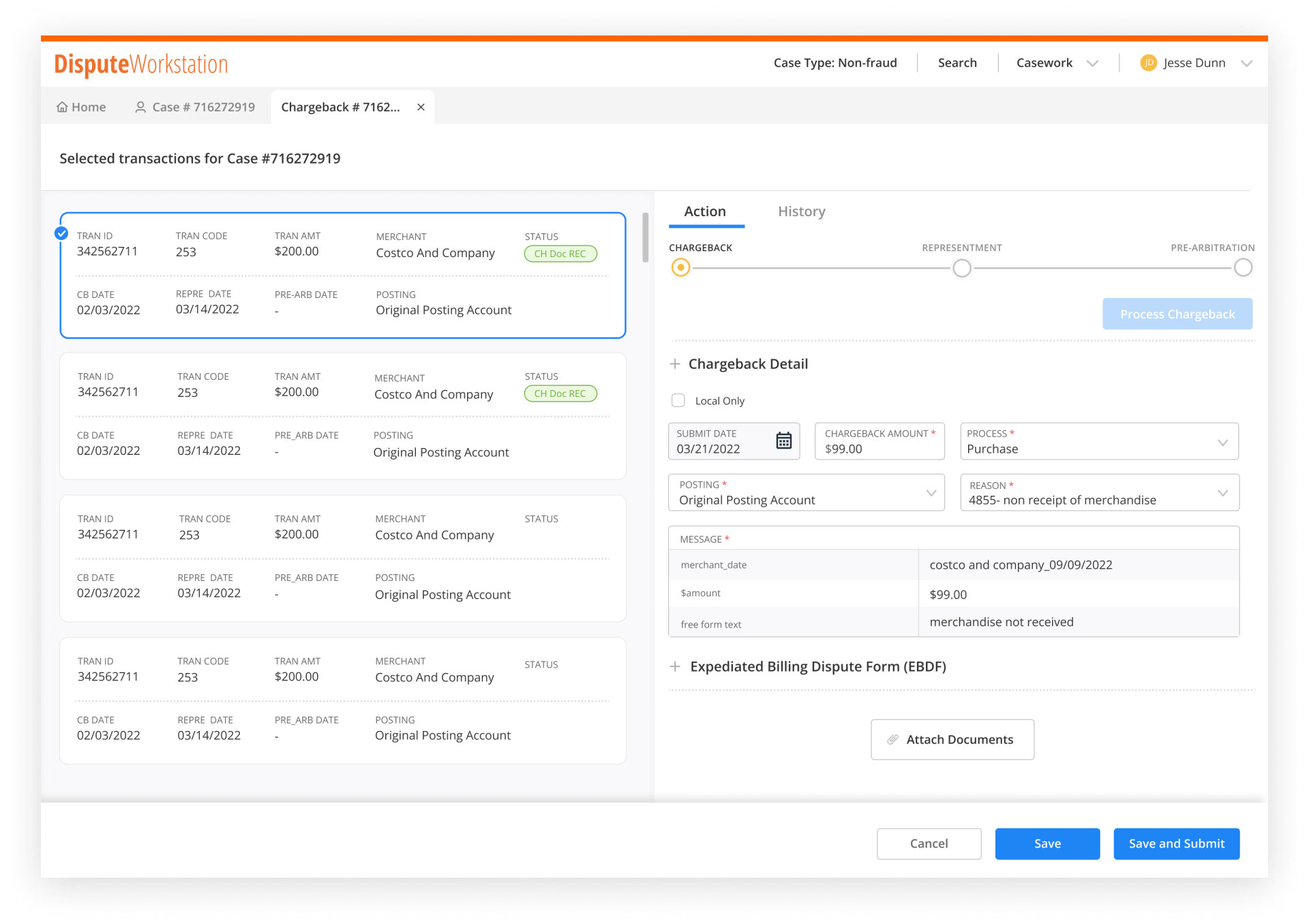

The user-friendly web application allows agents to easily research credit-card transactions, submit chargebacks to Visa and Mastercard, attach documentation, and manage the dispute lifecycle. The interface provides instant access to appropriate information, thus enabling faster decision-making and an optimized dispute resolution process.

Built-in SLAs

Get Next Case feature improves an agent’s case processing, prevents human error and upholds regulatory deadlines with built-in compliance and urgency-driven case prioritization.

Right information at the right time

The interface adapts to the dynamic changes to the network regulation processes, customers’ procedures, and configurations giving analysts right information at the right time.

Intuitive Disputes Processing

Workflow configurations guide analysts to the next appropriate action, greatly reducing the need for extensive disputes training and the risk of workflow errors.

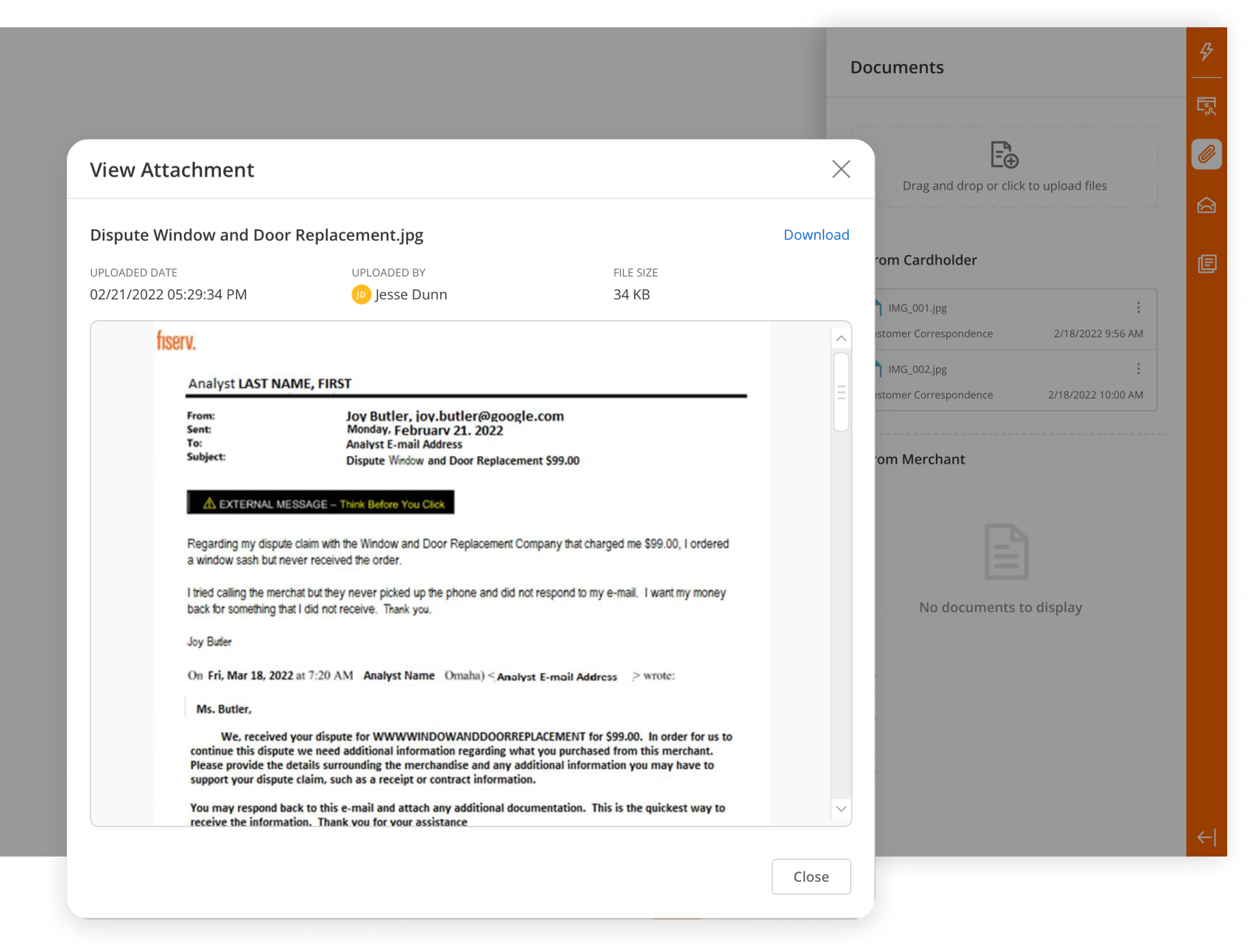

Faster Resolution Times

With all supporting documents, cardholder correspondences, and case notes in one place, evidence reviews are more efficient, increasing turnaround times.

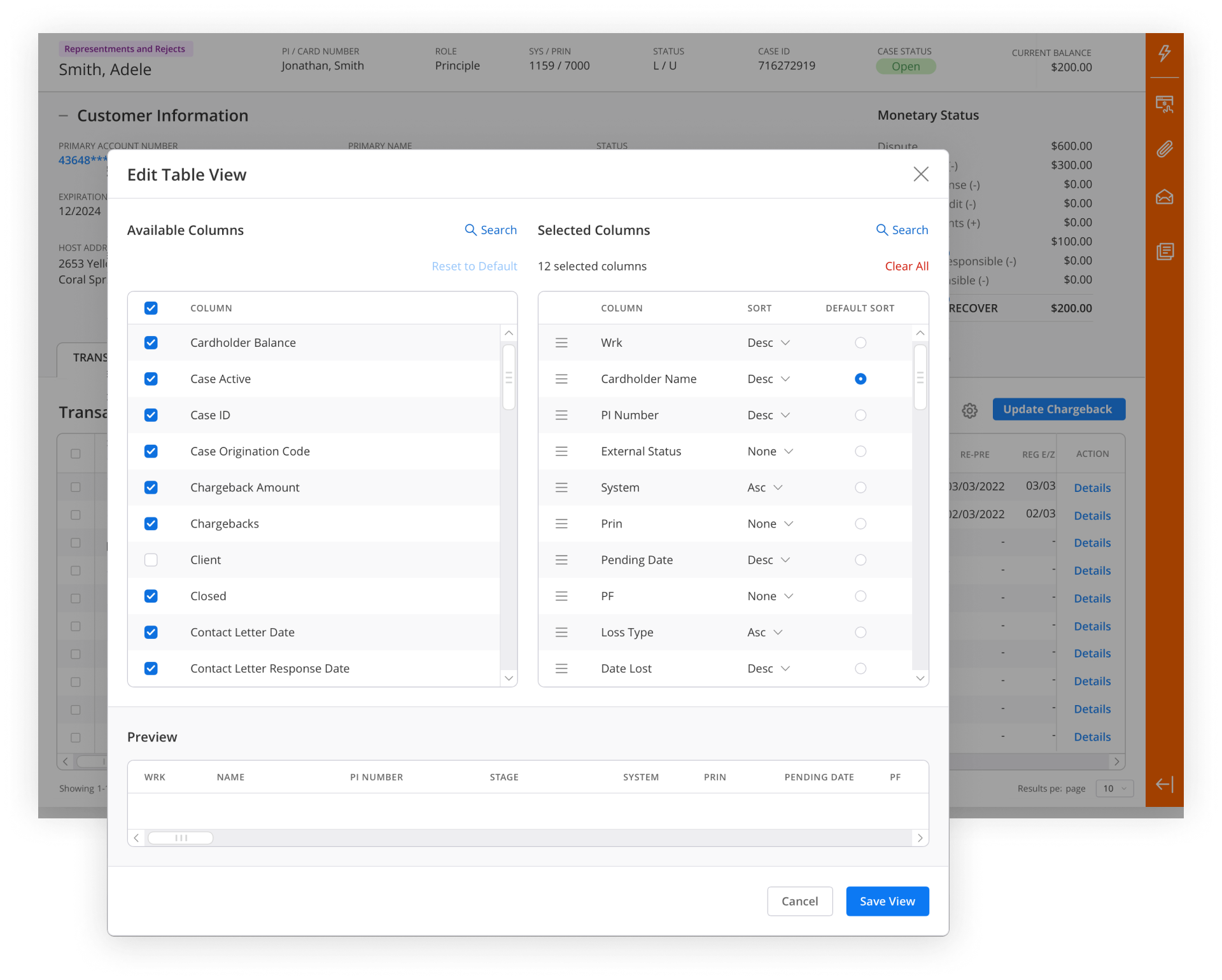

Complete control of their workstation

Every agent has a unique way viewing information. They can customize the interface to suit their specific needs.

Impact

54%

Increase in System Usability Scale

30%

Increase in agent productivity

Seven different applications down to one interface through APIs.

Seamless integration through APIs to attach and view documents on Dispute Workstation.

Creation of feature to directly compose letters from Dispute Workstation.

“I like the setup of it. It’s very familiar with me feels like I’m signing in to a regular website. It’s not a ton of information at once. That’s what I need, when I need. ”

Patty, Great Western Bank